Rippling PEO Software

Compliance

Payroll

Benefits

Compliance

Payroll

Benefits

on modern software

Rippling's PEO software handles important but tedious administrative tasks so you can focus on what matters—growing your business.

By clicking "See Rippling," you agree to the use of your data in accordance with Rippling's Privacy Notice, including for marketing purposes.

What is a PEO?

A professional employer organization (PEO) is a technology and service offering that takes payroll, benefits, HR, and compliance work off your plate, so you can focus on growing your business.

Rippling PEO

Rich benefits

Provide big company benefits packages at affordable and predictable rates—delivered through easy, online benefit enrollment.

Automated payroll

Run payroll in 90 seconds and as many times as you need—at no extra cost, and no calculator required.

24/7 compliance

Rippling proactively tracks changing federal and local employment laws and automatically manages your tax accounts and filings.

HR tools & experts

Gain exclusive access to SHRM/PHR-certified experts so you can confidently navigate complex HR management decisions.

Unified platform

Rippling unifies all your HR solutions in a single platform, enabling powerful automation, better reporting, and more.

Automated Payroll & Premium Benefits

Benefits employees love. Automation HR teams need.

Better benefits for your team

Provide employees access to big-company medical, dental, and vision insurance plans through national carriers as well as mental health, flex, and commuter benefits.

Benefits and payroll made easy with automation

Rippling's best in-class technology automates the tedious parts of running payroll and administering benefits enrollment. Rippling automatically prompts employees to enroll in benefits during their onboarding and automatically syncs all deductions for seamless payroll runs.

potential benefits savings

50

Total employees

Off Rippling PEO

$450,000

/year

On Rippling PEO

$361,250

/year

Total savings

Average cost per year for HR, Medical, Dental, Vision

/year

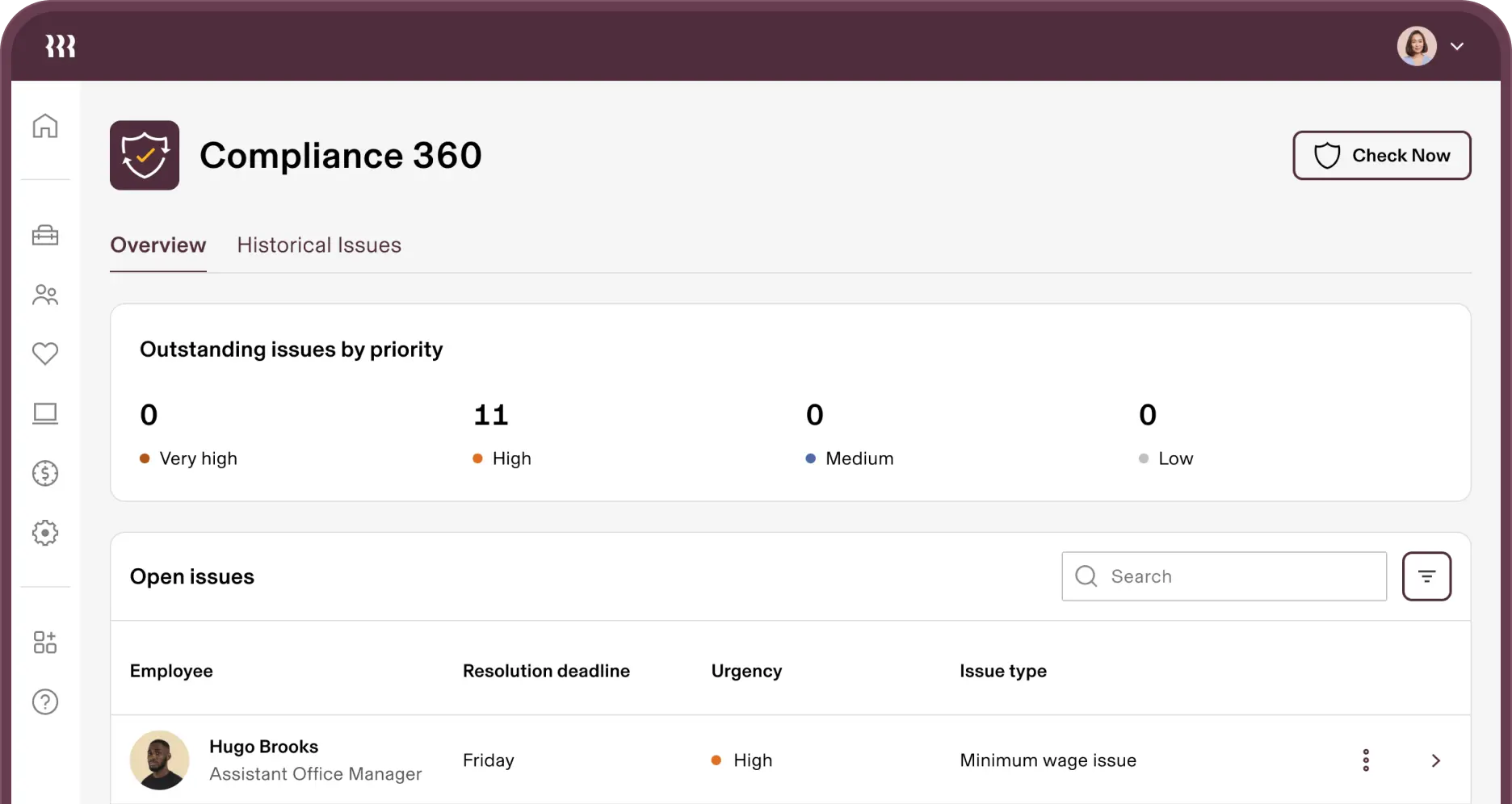

Compliance automation

Compliance automation with expert HR support

Maintain compliance without the hassle

Rippling keeps you more compliant than any other PEO software by automating all your compliance work, like setting up state payroll tax accounts and proactively detecting and resolving infractions. Here are a few other examples:

- Automatically calculating and filing state taxes

- Issuing and managing COBRA for terminated employees

- Covering you against claims with EPLI and workers’ comp

- Sending required new hire notices to state agencies

Get HR support from our certified experts

Unlike other PEO solutions, Rippling's HR experts are PHR/SHRM-CP certified to help you confidently navigate complex HR decisions.

Unified platform

PEO services powered by best-in-class software

Let employees manage all their benefits in one place

Employees love Rippling because it gives them one, intuitive app for accessing and managing all of their benefits like digital insurance cards and work apps like Payroll and Time Off.

Run powerful reports with a couple of clicks

Direct access to the employee data in Rippling’s applications lets you build custom reports that no other system can—like comparing overall benefits usage against employee satisfaction scores.

“Now that Rippling does state tax registration automatically, I don’t even have to think about it. It was a real pain before. Now it’s seamless.”

Hayley Trace People Business Partner

50%

workforce growth in a year using Rippling

$146k

saved on annual benefits costs

28

states where employees are located

Read full case study

Easily turn Rippling PEO

Easily turn Rippling PEO off and on

If your company ever outgrows our PEO, you can seamlessly transition off it with the click of a button. Best of all? You’ll be able to keep your HR, payroll, and employee data on Rippling intact.

Built different

Analyze, automate, and orchestrate anything

Most "all-in-one" software consists of acquired systems. These modules are disconnected, so your business data is, too. Rippling takes a platform approach, building products on a single source of truth for all the business data related to employees. This rich, flexible data source unlocks a powerful set of capabilities.

Permissions

Automatically govern what each person in your company can see, do, and access.

Policies

Build custom policies that enforce your business’s unique rules and procedures.

Workflows

Automate virtually anything with hyper-custom triggers and advanced workflow actions.

Analytics

Make better decisions faster with real-time, unified data in an easy-to-use report builder.

FAQs

What does PEO stand for?

PEO stands for professional employer organization.

What is a PEO services company?

What is an example of a PEO?

Is Rippling a PEO?

What is the difference between PEO and HRIS?

How do I choose the best PEO for my company?

See Rippling in action

Learn how Rippling PEO helps with payroll, benefits, HR, and compliance.