Introducing Rippling: The all-in-one workforce platform now available in Ireland

As we open our new European Headquarters in Dublin, Rippling is now available for companies headquartered in Ireland! The first truly all-in-one workforce platform with built-in payroll, HRIS, benefits, and more, Rippling offers access to over a dozen products that support your Irish and global employees.

This week, Rippling Ireland colleagues met with Irish Trade Minister Simon Coveney TD to discuss the new opening. We plan to hire 100 people initially, as we look to transform payroll, HR, IT, and finance processes in Ireland.

Minister Simon Coveney TD with members of Rippling’s Ireland team

The problem with payroll and HR in Ireland today

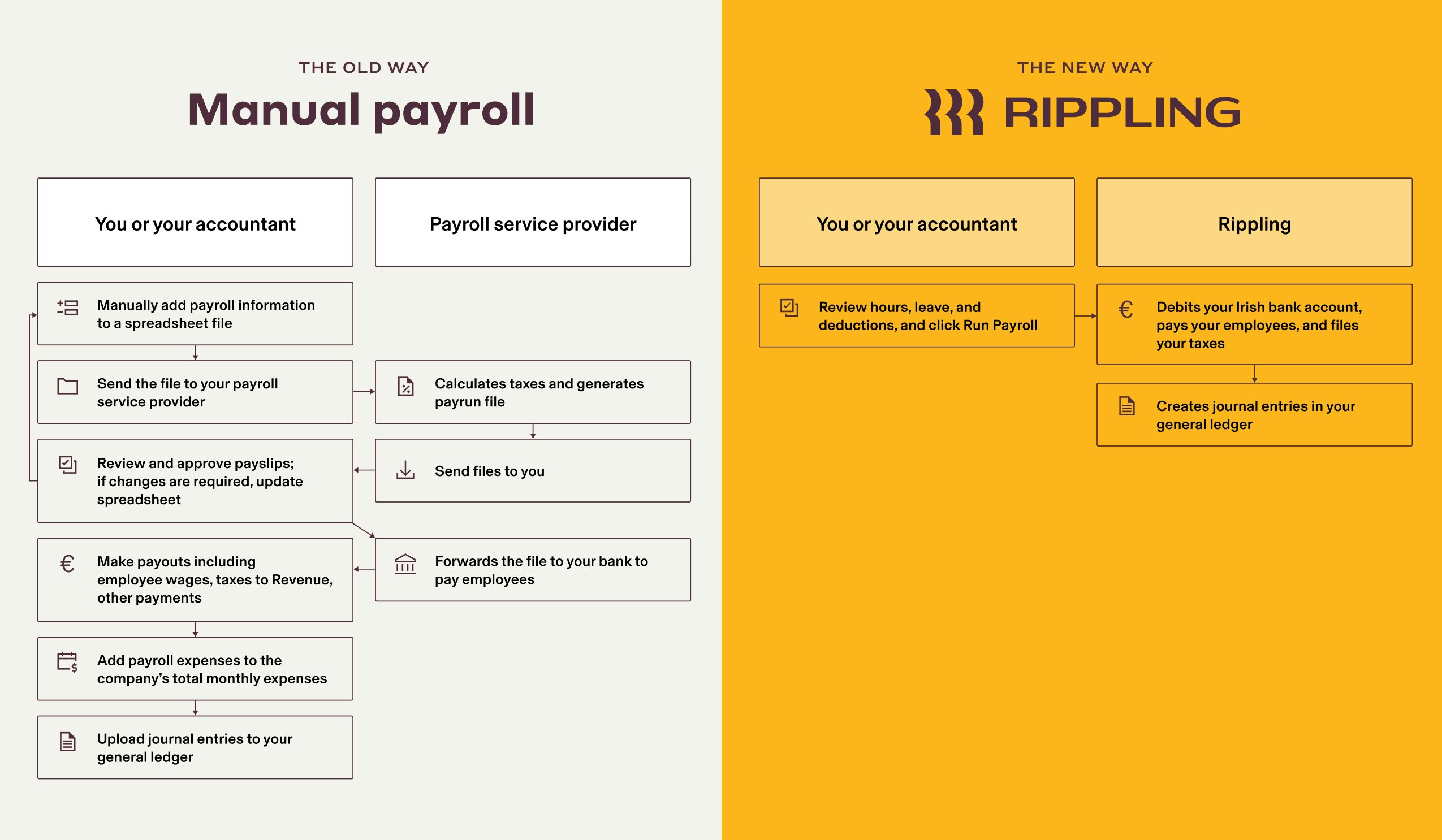

Today, most businesses in Ireland utilise a variety of disconnected systems and outsource payroll. They send emails, spreadsheets, and bank files back and forth with their payroll provider (and their accountant, if they have one). Since these payroll services aren't integrated with an HR system, businesses have to manually update employee data, including salaries, leave, and deductions. If they don’t make these updates in time, those items aren’t reconciled until the following pay period. By the time funds hit your employees’ bank accounts, it’s often 10-15 days later than when you started. Needless to say, this process is rigid, error-prone, and incredibly slow. And if you’re the one managing it, it’s stressful, too.

Outsourcing payroll and HR also limits your reporting. Your workforce data lives outside of your organisation, fragmented across multiple systems, so you can’t just run a report. Instead, you’re forced to make requests and manually piece together data to understand your own business.

Payroll is one example. But these limitations drag down every employee system in Irish businesses.

With technology advancing in so many other fields, how have payroll and HR stayed untouched?

For starters, there is no all-in-one system in Ireland with HR, payroll, benefits, and all the other tools you need to manage your employees. As a result, businesses like yours are forced to use spreadsheet uploads or simple integrations.

On top of that, no payroll provider in Ireland has automated the movement of funds from their system to your bank to pay your employees.

Here’s what the payroll process looks like today: multiple parties involved with a laborious series of steps, like data entry, manual calculations, and file transfers.

But there’s good news: something better has arrived.

Introducing Ireland’s first automated payroll system

Rippling Payroll is deeply integrated with everything that touches payroll, including time tracking, benefits, pension, and leave. That means all of your employee data—like salary increases, new starters, hours, deductions, leave, and more—automatically sync with payroll for a completely seamless experience.

When it’s time to run payroll, you can review all of your payroll inputs in a matter of minutes, then click “Run payroll.” Rippling automatically calculates your taxes and pays your employees.

In other words, you don’t need to spend days trying to run payroll yourself. You just review and approve, and Rippling runs it for you.

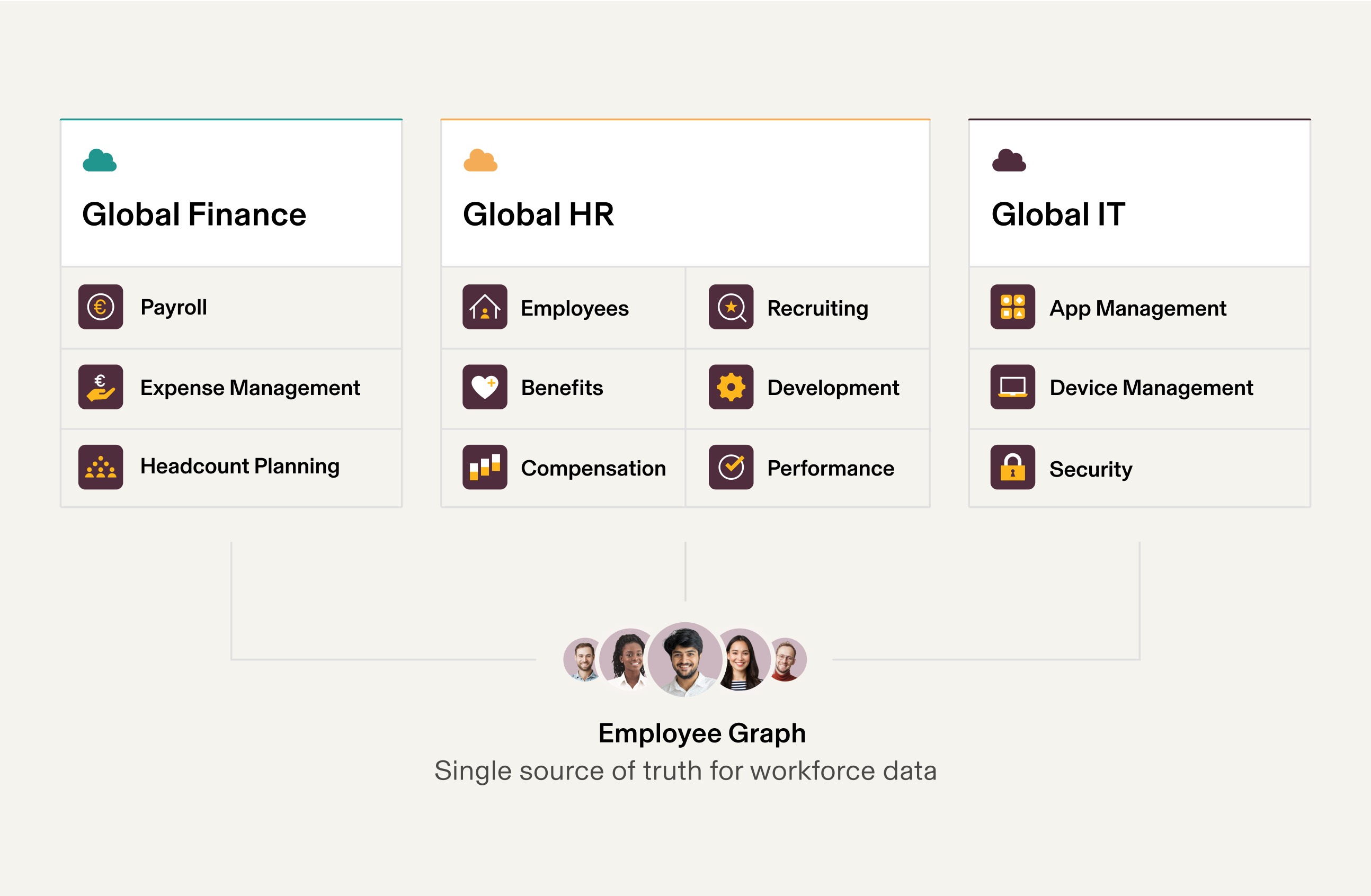

Everything you need to run a workforce in one place

Your current HR vendor might claim to be “all-in-one.” What they really mean is they’ve built integrations with third-party systems so that employee information can flow from one to the other. This approach can only take you so far since third-party integrations are limited by the amount of information that can be shared.

In addition to payroll, we’ve built every application you need to run your workforce, making Rippling the first truly all-in-one workforce platform.

HRIS: Rippling’s HRIS is the source of truth for all of your employee data. By bringing all of your employee data together, you can manage and automate every step of the employee lifecycle, from onboarding to transitions to offboarding. Employees can self-serve, too. You no longer need to punch in sensitive employee data during onboarding, update their bank account details when they change, or manage their leave requests and balances manually out of spreadsheets or separate systems.

Reporting: When you manage your entire workforce in one system, reporting becomes a breeze. You no longer have to export data from a dozen systems into Excel to get the answers you need. With Rippling, you can report on every piece of employee data—salary, equity, expenses, survey results, and thousands of other data points—in a single system. If you have global employees, Rippling even converts currencies inside of reports—no manual number-crunching.

Benefits administration: Rippling makes it easy for your new hires to enroll in benefits in Ireland, like private health insurance. We partner with top local brokers to bring you directly to the source. Already have a preferred broker? No problem. They can also integrate your plans into Rippling Benefits Administration so you can manage deductions, employee changes, and open enrollment—all in one simple, online experience.

Time tracking: Rippling Time & Attendance syncs seamlessly with Rippling Payroll, so you never have to track or enter hours outside of your HRIS.

Policy management: Rippling empowers you to design policies that can be applied company-wide or to groups of employees in specific locations. For example, you can design a global annual leave policy that gives all employees five weeks of paid holiday and an additional day per year of tenure.

Compliance: We’ve built compliance rules into every product throughout Rippling to help you protect your business. For example, we’ll flag if you’re paying an employee less than €11.30 per hour, so you don’t run afoul of Ireland’s minimum wage law. We’ll also flag if you’ve added an employee to a non-compliant sick leave policy and provide guidance on how to fix that policy.

Expense reimbursements: Rippling lets you build reimbursement policies based on employee data. As a result, it can automatically approve, block and flag expenses faster than other systems. You can also drill down into reimbursement requests directly in payroll. This lets you quickly answer the question of why somebody spent €500, without having to personally put them on the spot.

And if you have a global team, you can use Rippling to manage them, too. Everything in Rippling – from onboarding and offboarding to compliance rules and policies – is automatically localised based on each employee’s location. That means you’ll never have to use siloed HR systems again.

With this launch, we’ve come one step closer to our goal of freeing smart people to work on hard problems. We can’t wait for Irish businesses like yours to experience the power of Rippling.