What are payroll reports? Types, examples, and template

If you’re managing payroll for a business, you know how quickly things can get complicated. Tracking compensation, withholdings, and payroll taxes for employees and contractors is not for the faint of heart, even for small businesses. A payroll ledger keeps every payment organized, supports compliance, and makes tax reporting easier. Without one, errors can pile up, leading to messy records and even an audit.

In this article, we’ll break down exactly what a payroll ledger is, why it matters, and how to create one for your business. Whether you use a structured template, an Excel sheet, or payroll software, we’ll guide you through key elements and best practices.

What is a payroll ledger?

A payroll ledger is a detailed record that tracks all of your business’s payroll transactions, from employee wages to deductions and payroll taxes. You can use your payroll ledger to monitor labor costs, manage payroll expenses, and reconcile payments with your general ledger. It’s also an important financial reference point that can help ensure accurate recordkeeping across pay periods for compliance, reporting, and budgeting purposes.

Typically, a payroll ledger will include columns for:

- Employee wages and salaries to track hourly wages, salaries, and overtime payments.

- Payroll expenses to record employer-paid costs like benefits or contributions.

- Payroll taxes to document tax withholdings and employer obligations.

- Deductions to capture amounts withheld for private insurance, retirement plans, garnishments, and other additional withholdings.

- Net pay to reflect the final amount employees receive after deductions and withholdings.

3 benefits of an effective payroll ledger

A payroll ledger is more than just a compensation record; it helps your business track payroll costs, manage cash flow, and stay on top of compliance requirements. Properly maintaining your payroll ledger can help prevent inaccuracies in important payroll calculations, monitor overall financial health, and avoid tax issues.

1. Accurate payroll processing

Because your payroll ledger includes all of your business’s essential payroll data, from wages and salaries to hours worked to deductions and net pay, you can use it as a comprehensive information source for how much you spend on payroll for each pay period. Keeping this information up-to-date can also help you align your pay runs with the general ledger and ensure that employees receive the correct compensation.

2. Easy tax reporting and compliance

Accurate payroll records are essential for tax reporting and audits. A detailed payroll ledger puts all the information that you or the IRS might ever need at your fingertips. Payroll ledgers also help you meet business requirements for recording tax withholdings and payroll schedules, and using a spreadsheet or an automated payroll system can dramatically cut down on calculation errors.

3. Improved financial transparency

Payroll is almost always one of a business’s largest expenses. By consolidating all compensation-related information into a single record, a well-maintained payroll ledger can give you visibility on how much you spend on hourly wages, salaries, payroll tax, and benefits to help you budget effectively. Data in your payroll ledger also feeds into payroll reports, which decision-makers rely on for insights into labor costs.

How to create a payroll ledger: 5 key elements

Creating a payroll ledger can be as simple as opening a spreadsheet or as layered as linking multiple software tools into a payroll system. Depending on the size of your business, you’ll likely need to choose between developing a payroll ledger manually in Excel or Google Sheets, using a template, or relying on automated payroll software.

Regardless of which method you choose, be sure your payroll ledger includes the following elements.

1. Employee information

Each ledger entry needs to include key employee payroll details like name, job title, employee ID, and pay type (hourly or salaried). Organizing information this way makes it easy to sort or locate in case of an audit.

2. Payment details

Tracking hours worked, gross pay, and overtime per pay period prevents mixups when it's time to calculate compensation and run payroll. Whether you use payroll software or a spreadsheet, structure these columns correctly for accurate pay runs and payroll reports.

3. Deductions

Payroll needs to account for tax withholdings, health insurance, retirement plans, and other voluntary deductions. Without a structured payroll ledger, you might miscalculate these amounts and create compliance issues or payroll discrepancies.

4. Net pay

After deducting taxes and benefits, the net pay column reflects an employee’s take-home earnings. Recording this correctly helps ensure that employees get paid correctly and that your payroll expenses align with other company financial records.

5. Employer contributions

A complete payroll ledger should also track any employer-paid taxes, benefits, and retirement contributions. Some of these, such as taxes, need to be reported periodically to regulators, and it’s important to track them across multiple sources.

How to use a payroll ledger: 3 tips

Your payroll ledger is only useful if it’s well-organized and updated consistently. You need to track the right payroll data, record it on time, and store it in a clear, easily accessible format. These best practices help keep your payroll accurate, compliant, and straightforward to manage.

1. Determine specific data sets

Clearly defining the essential data points in your payroll ledger prevents mistakes in important calculations—especially if you’re using a spreadsheet. A complete record must include, at minimum, columns for hours worked, gross pay, deductions, and net pay, broken down by pay period.

2. Adhere to a schedule

Recording payroll consistently, whether that means weekly, monthly, or per pay period, keeps your records up to date and reduces the likelihood of discrepancies. Missing entries can lead to errors in tax withholdings, payroll expenses, and even employee payroll. Beyond making payroll management painful, those mistakes can trigger audits.

3. Keep records in one place

Beware of scattered spreadsheets and loose files. A well-organized payroll ledger works by centralizing data, not spreading it across multiple programs and systems. If your payroll ledger relies on multiple data sources, be sure they’re likewise easily accessible in case you need to review how financial information migrates into the payroll ledger.

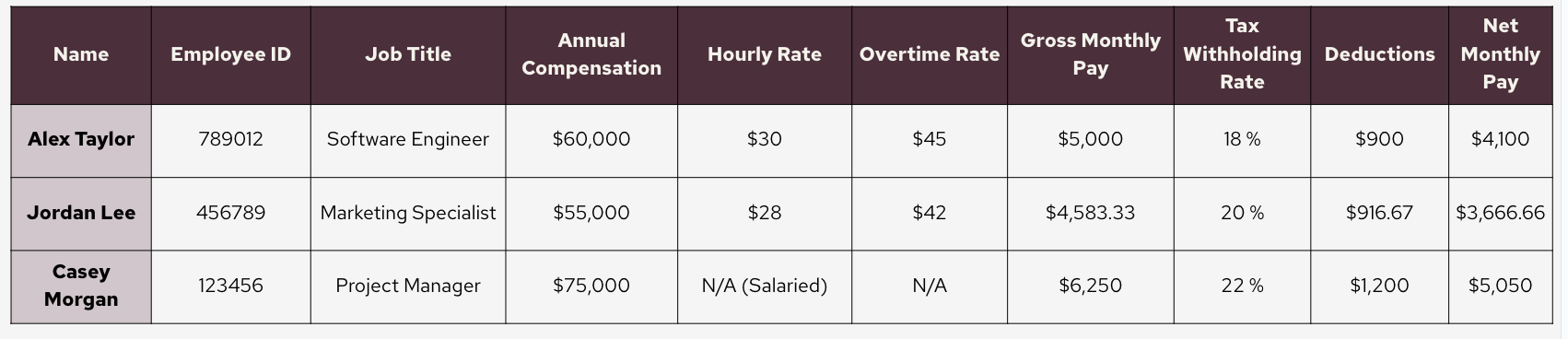

Payroll ledger example

Wondering how to format your payroll ledger? The monthly payroll ledger template below illustrates one way to organize the key information.

ACME Co September Payroll Ledger

Automate payroll ledgers with Rippling

If you want payroll so powerful it runs itself, you want Rippling's payroll software. Rippling offers full-service payroll with everything we’ve discussed in this article so far, plus even more—it’s built on top of a single source of truth: employee data. That means your employee data isn’t tied to one specific app—it’s the same across payroll, time and attendance, onboarding, performance management, and any other apps you use within our unified platform.

What does that mean for you and your team? For starters, you have a single source of truth for up-to-the-minute employee information. It also means that your team doesn’t have to reenter information across systems when an employee gets promoted or moves to a different city to work remotely. From changing security permissions to updating PTO policies, Rippling triggers automatic updates to employee information in a single flow. This is especially beneficial for small businesses. It allows you to do more with less—less money, less headcount, and less time. And all with a 100% error-free guarantee.

With Rippling you can:

- Pay employees and contractors on the same platform

- Manage time and attendance natively

- Run unlimited off-cycle pay runs at no extra cost

- Set up multiple pay schedules, pay rates, and pay types in just a few clicks

- Automatically calculate prorated pay runs for new or promoted employees

- Automatically calculate overtime

- Make changes after submitting payroll

Payroll ledger template FAQs

What is the general ledger for payroll?

The general ledger for payroll is a financial record that tracks all payroll expenses for each pay period, including gross pay, deductions, net pay, and tax or other withholdings. It helps ensure accurate financial recording by categorizing entries under accounts like wages, payroll taxes, and benefits. Small businesses may also use the general ledger for payroll to reconcile payroll costs with the payroll register and other accounting records for a big-picture view of payroll liabilities.

Can I use Excel to create a payroll ledger?

You can use Excel to create a payroll ledger by setting up a spreadsheet with columns dedicated to employee payroll details like hours worked, gross pay, deductions, net pay, and tax withholdings. Insert formulas to automate the calculations for each pay period and ensure accuracy. Not a math whiz? You can also use an Excel template. Excel can also help you design a custom payroll report to track expenses and keep your general ledger organized.

How do you automate payroll ledger creation?

You can automate payroll ledger creation by choosing payroll software that integrates with tools like Excel and Google Sheets. After the software calculates gross pay, deductions, net pay, and tax withholdings for each pay period, it automatically exports the data into a spreadsheet or general ledger, mapping entries like hours worked, compensation, and payroll deductions into predefined columns. Other tools provide templates that generate structured payroll reports, cutting down on the time and risk associated with human intervention.

This blog is based on information available to Rippling as of March 18, 2025.

Disclaimer: Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.