Introducing Rippling Visa Corporate Cards in Canada

Rippling has been supporting Canadian companies with HR, payroll, IT, and more since 2022. Now, we’re expanding our services with the launch of Rippling Corporate Cards in Canada,* in partnership with Visa.

Rippling Corporate Cards are a powerful new product line within Rippling Spend, which allows companies to manage all of their employee spend in one place alongside HR and payroll.

Rippling Spend now includes Expense Management and Corporate Cards in Canada, allowing you to consolidate your workforce systems into a single platform with more visibility and control over company spend than standalone spend solutions.

Before we dive into the details, though, it’s important to understand the limitations of today’s standalone spend management systems in Canada.

The challenge with standalone spend management systems in Canada

Traditional spend management systems in Canada come with two significant limitations:

- Fragmented spend. Siloed systems do not integrate with payroll, making it difficult to view and manage all company expenses in one place. This fragmentation forces teams to generate multiple reports and manually consolidate data, wasting valuable time. For example, payroll admins need to switch between different systems to investigate large reimbursements, adding to their workload.

- Disconnected from HR systems. These systems don’t integrate with your HRIS, limiting access to critical employee data such as departments and job titles. This omission hinders the ability to control spending effectively and increases administrative tasks for HR, finance, and management. For instance, siloed systems can’t automatically block employee spend based on location or department, nor can they route expenses for approval based on organizational structure.

Fully automate your corporate card program with Rippling

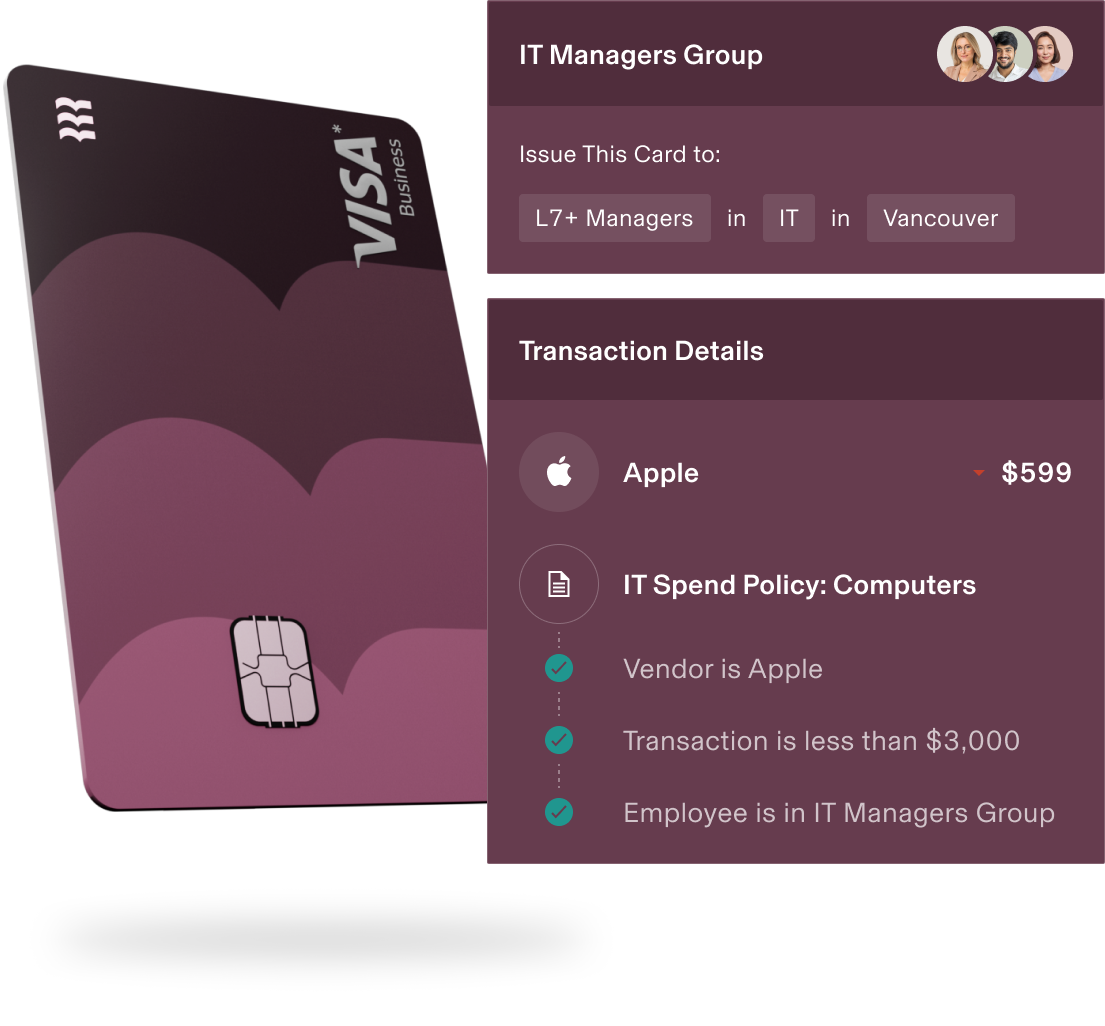

Rippling Corporate Cards are the first corporate cards in Canada with a built-in back office that eliminates nearly all of the administrative work your team has to do today to issue, manage, and revoke cards. With Rippling, you can automatically issue cards to new hires with preset limits and spend policies based on their role. Rippling will even update the card limit and policies whenever there’s an employee lifecycle event, like a promotion.

With Rippling’s corporate cards, you can:

- Automatically issue cards: Automatically issue physical corporate cards to teams who need them. For example, you can set a policy to issue cards to all Sales Executives in the Enterprise Field Sales department who have been with the company for more than 90 days.

- Set granular policy rules & permissions: You can set expense budgets and categorize spend types that are permissible versus blocked. For example, you can set a budget for specific categories like client meals or client travel. You can also set policies that block transactions over a certain threshold and alert employees via SMS about blocked transactions.

- Automate home office stipend approvals: Create a custom policy to automatically approve expenses for office equipment under $500, and ensure it’s only available to remote employees who have been with the company for more than 90 days.

- Monitor software licenses: Block out-of-policy software purchases by leveraging Rippling’s data about existing corporate licenses and employee roles. For example, employees often use personal credit cards to buy software like Microsoft Office or Adobe, which the company already has licenses for. Rippling can automatically block these expenses and direct employees to the correct person, saving significant costs.

- Seamlessly integrate with spend management: Fully integrated with Rippling Spend, our corporate cards enable you to manage all expenses, including payroll, in one unified platform. This integration eliminates the need to switch between systems or manually merge data.

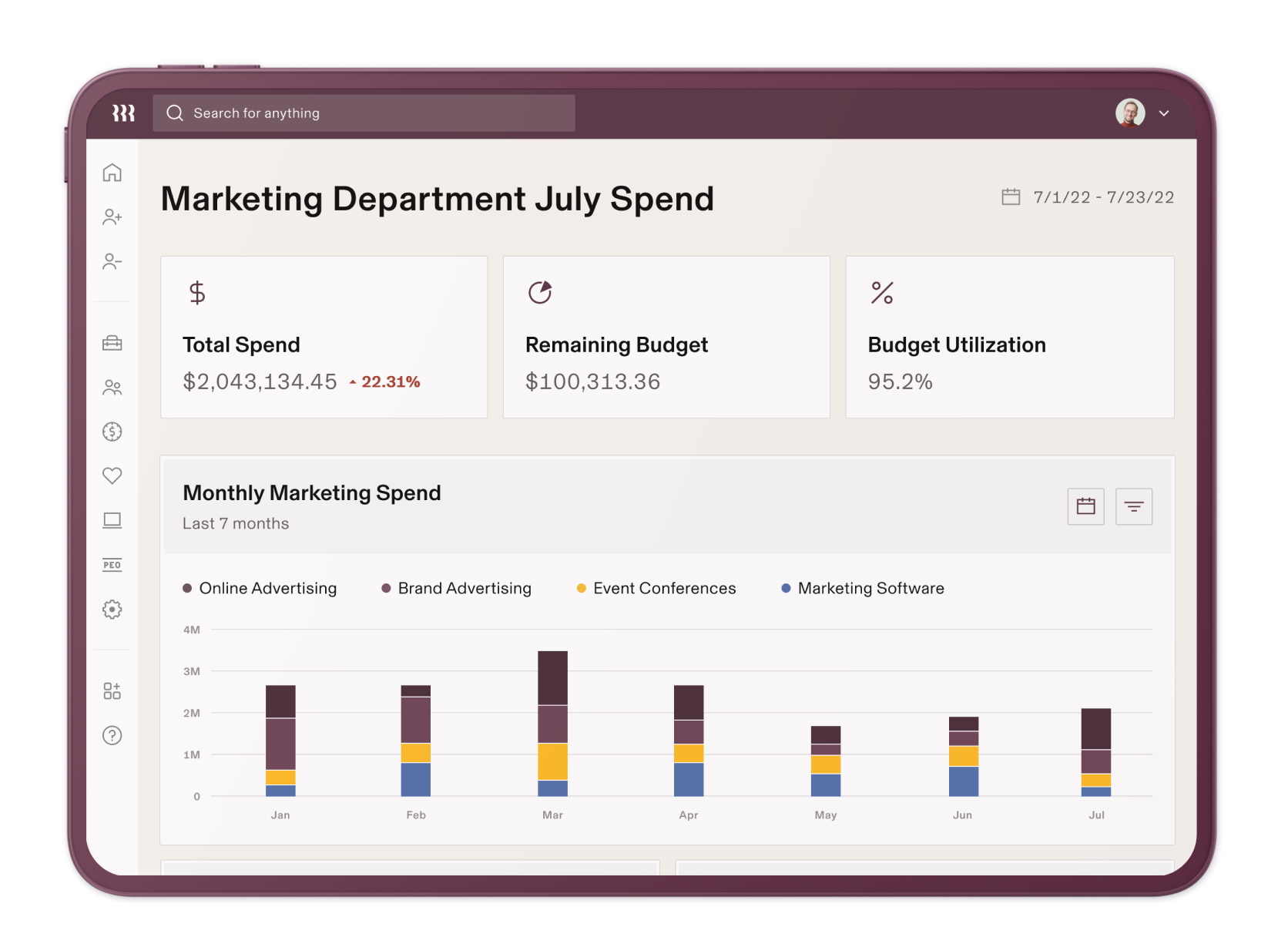

Easily calculate all your monthly cash burn without spreadsheets

With all your spend consolidated into Rippling, you can gain insights into salaries, card transactions, reimbursements, bills, and even payroll, in one system. No more logging into different platforms or merging data in Excel to figure out your monthly cash burn.

For example, you can now view card spend by department and drill down into reimbursement requests. And managers can run in-depth reports on their own department’s spend and self-serve to get the information they need.

Ready to transform your spend management?

Experience the power of Rippling Corporate Cards. Whether you choose to use them as a standalone product or as part of our comprehensive Spend suite, Rippling is here to streamline your corporate expenses.

Automate expenses with complete control

*Excluding Quebec and Saskatchewan.

This blog is based on information available to Rippling as of September 17, 2024.

Disclaimer: Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.