New PPP Loan Forgiveness Law Gives Borrowers More Flexibility

Late last Friday, millions of businesses that have been anxiously waiting to hear how they can get their Paycheck Protection Program (PPP) loans forgiven finally got an answer…sort of. Three weeks after the original deadline, the Treasury Department and Small Business Administration (SBA) released a PPP loan forgiveness application, but no “instruction manual” to go along with it.

Update 5/25/20

On Friday, May 22, the government released two “interim final rules” (here and here) to guide borrowers and lenders with the loan forgiveness process.

Update 6/5/20

The Paycheck Protection Program Flexibility Act was signed into law, providing a number of helpful updates for PPP loan recipients. The SBA and Treasury has advised that additional guidance will be forthcoming. In the meantime, here are key highlights:

- Increased loan forgiveness period to 24 weeks (instead of 8 weeks)

- Increased amount of non-payroll costs may be forgiven, now 40% (instead of 25%)

- No reduction in loan forgiveness if reduced headcount and wages are restored by December 31, 2020 (instead of June 30, 2020)

- PPP loan borrowers also qualify for social security tax deferrals (see here for more information on payroll tax deferral program and how Rippling can help)

- PPP loan borrowers that do not have all or some of their loans forgiven will now have five years to pay back the loan (instead of two years)

Update 6/17/20

Treasury released a three-page EZ PPP Loan Forgiveness Application and accompanying instructions for businesses that did not reduce headcount or wages or were unable to operate at prior levels (more guidance needed on what “unable to operate” means). For these businesses, it will no longer be necessary to calculate headcount and wage reductions nor to submit PPP Schedule A from the long-form application.

This post has been updated to reflect the new law and guidance.

Update 12/31/20

On December 27, 2020, President Trump signed the Consolidated Appropriations Act of 2021, which provides new stimulus relief for small and medium businesses impacted by COVID-19. Highlights include:

- New Paycheck Protection Program (PPP2) Loans of up to $2 Million. Congress authorized $284 billion in new PPP2 loans of up to $2 million each, provided that companies meet some additional qualification criteria. Eligible businesses have (1) fewer than 300 employees and (2) experienced a 25% or greater decline in gross receipts in 2020 compared to the year-ago quarter. The PPP application process is expected to be similar to the first-round of PPP loans, but with a maximum allowable loan amount of $2 million, down from $10 million in the original program. Additionally, companies with NAICS code 72 (hotels and restaurants) may request a PPP loan of 3.5 times their monthly payroll (instead of 2.5 times for all other companies). We expect banks to begin accepting PPP2 loan applications in the middle of January.

- Helpful Updates to PPP Loan Forgiveness. The stimulus bill also made several helpful updates to the PPP loan forgiveness process, including:

- Expanded covered expenses. Covered expenses for PPP loan forgiveness now include protective equipment costs, software expenses (such as your expenses for Rippling services), among other items. This also applies to original PPP loans, if you have not already applied for forgiveness.

- Deductibility of covered expenses. Business expenses paid for with forgiven PPP loans will now be tax deductible, allowing companies to reduce their overall tax bill in this upcoming year.

- Simplified PPP loan forgiveness process for loans under $150,000. Companies with less than $150,000 in PPP loans will now be able to use an easier short-form forgiveness application. If you have not already applied for forgiveness for an existing PPP loan, please consult with your lender about the new process.

The original 11-page application gives a first look into how the government will assess loan forgiveness — and raises almost as many questions as it answers. More guidance is expected this week. In the meantime, we’ve summarized the essential rules to know and how to get your application in order, step by step.

Congress created PPP back in April to encourage companies with fewer than 500 employees to keep people on payroll through the economic turmoil caused by COVID-19. But business owners have discovered that the loan, which was billed as “100% forgivable” (aka free government money), actually comes with quite a few strings attached. Some 4.4 million loans totaling over $500 billion have already been approved.

What are the rules for PPP loan forgiveness?

Federal agencies have issued more than 41 pieces of guidance on PPP. The barrage of rule changes have left borrowers scrambling to figure out whether they still qualify, how and when to use the funds, and if the loan is even worth the trouble. The Paycheck Protection Program Flexibility Act signed into law on June 5, 2020, provides much needed flexibility to borrowers — further guidance will be forthcoming. Here’s what we know so far about loan forgiveness:

The good

- Loan forgiveness will not be reduced for borrowers who made a “good-faith, written offer” to rehire workers if the offer was declined. Many business owners have reported difficulties hiring back workers who are making more money from unemployment benefits or fear of being exposed to the virus. Treasury designed the application so borrowers won’t be penalized for this scenario: no loan forgiveness reduction will apply to any employee who declines a good-faith, written offer to return to work, or for full-time employees who were fired for cause, voluntarily resign, or voluntarily request a reduction in hours

- Payroll costs include those “paid” and “incurred but not paid out” during the forgiveness period. Borrowers may include payroll costs paid during the 8 or 24 weeks but incurred previously (although how far back is anybody’s guess). They may also include costs “incurred but not paid” until the next regular pay period. If you weren't planning on paying out expenses like sales commissions until the end of the quarter, consider doing it sooner so they qualify for loan forgiveness.

- PPP loans that are not forgiven become low-interest loans. Complete forgiveness doesn’t need to be the goal for every business. The loan has a low, 1 % interest rate over the course of two years, no payments necessary during the first six months, and no prepayment penalties.

The bad new

- Updated: The new PPP law extends the window in which funds must be spent from 8 weeks to 24 weeks. In other words, PPP loans must be spent in the 8 weeks or 24 weeks after borrowers receive the funds in order to qualify for full loan forgiveness, with up to a two-week delay for payroll timing.

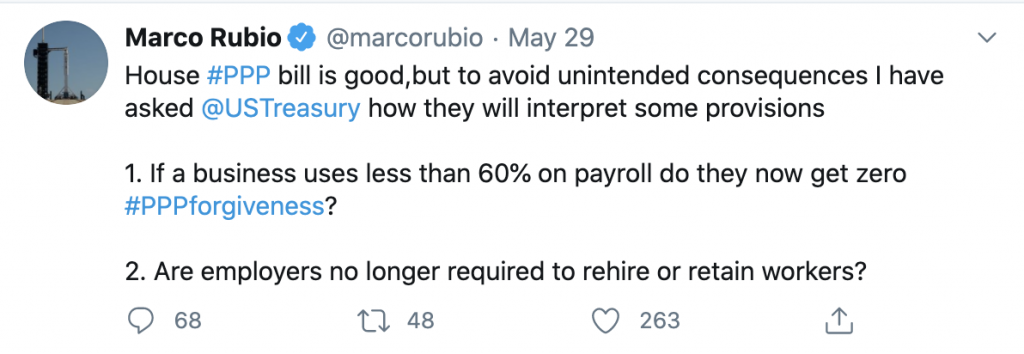

- Updated: The PPP Flexibility Act stipulates that 60% of the loan must be used to cover payroll costs. The requirement was previously 75%, which may have been part of the reason that at least 25% of small businesses never even bothered applying for PPP. Under the new law, no more than 40% of the loan can be used to cover non-payroll costs

The fine print

- It’ll be a pain to calculate loan forgiveness reductions. The amount of a PPP loan that’s forgivable is reduced if business owners cut jobs or wages. With the new application, the Treasury has clarified that businesses will need to calculate an average “full-time equivalency” number for every employee — a painstakingly granular process. More on how this works in the calculation section below

- Get ready to provide lots of supporting documentation — and keep it for six years. Yes, you read that correctly. The application states that businesses are required to retain all PPP applications and supporting documents for six years. It also warns that the “SBA may request additional information for the purposes of evaluating the Borrower’s eligibility for the PPP loan . . . [and] failure to provide information requested by SBA may result in a determination that the Borrow was ineligible.” So get those documents in order and into a safe place — more on that below

- Borrowers must certify again that they’re eligible for the loan and can prove their need. There’s lots of intimidating legalese in the application, which reflects growing scrutiny of successful businesses that obtained PPP loans. Borrowers from Shake Shack and Ruth’s Chris steakhouses to the LA Lakers have returned their loans under pressure

- The application includes seven new certifications that borrowers must sign under penalty of civil and criminal penalties. Notably, the form asks whether borrowers received a loan of more than $2 million. SBA said it would provide safe harbor to all borrowers of less than $2 million, in terms of deeming their certifications to have been made in good faith. But the government plans to audit all loans over that amount, and borrowers will be required to show the money was necessary to keep their operations running and that they had limited access to other funding

We’ll update this post as more guidance becomes available. Read on for the nitty gritty on calculating and documenting loan forgiveness.

What do I need to apply for loan forgiveness?

The PPP loan forgiveness application is long, dense, and written in legalese. Worse, it tends to jump around. For example, in order to fill in Line 1 of the application, you need to enter Line 10 of a separate form (PPP Schedule A), which in turn can only be calculated after filling out two worksheets.

If that sounds confusing, don’t despair! While we await additional SBA guidance, here’s what you need to do to prepare your loan forgiveness application — in plain English:

- Calculate eligible loan forgiveness amount, including:

- Eligible payroll costs

- Eligible non-payroll expenses

- Full-time employee and wage reductions

- Create, gather, and/or maintain documentation for all of the above

How to calculate loan forgiveness amount

There are a few main components to calculating loan forgiveness:

- You will need to calculate eligible payroll costs.

- You will need to calculate eligible non-payroll costs, capped at 40% of total loan forgiveness spend (or one-third of eligible payroll costs).

- You will need to calculate any wage reductions (if applicable).

- You will need to calculate your full-time employee (FTE) reduction quotient.

Once you have these four numbers — eligible payroll costs, eligible non-payroll costs, wage reductions, and FTE reduction quotient — you will be able to calculate your loan forgiveness as follows:

Note that your PPP Loan Forgiveness Amount cannot exceed the amount of your original PPP Loan. Additionally, if you applied for and received an Economic Injury Disaster Loan (EIDL), then the SBA will deduct the amount of any EIDL advance from your PPP Loan Forgiveness Amount.

Calculating Eligible Payroll Costs

Step 1: Select the applicable time period.

- For the purposes of calculating eligible payroll costs, you may choose to use one of two applicable time periods:

- Option 1 - Covered Period: 8 weeks or 24 weeks following your loan disbursement date, the date that you received your PPP loan from your lender, or

- Option 2 - Alternative Payroll Covered Period: 8 weeks or 24 weeks beginning on the next regular pay period following your loan disbursement date, provided that you run payroll on a bi-weekly or more frequent basis.

- Please note that if you regularly run payroll on a semi-monthly or monthly basis, you will need to use the time period indicated in Option 1 - Covered Period.

Step 2: Calculate aggregate payroll costs.

- Include employee compensation in the United States, cash tips, paid leave, employee portion of health insurance and retirement, employee portion of all federal, state, and local taxes, and any dismissal or separation payments.

- Include the above payroll costs paid during the applicable time period.

- Include the above payroll costs incurred but not paid until the next regular payroll date after the applicable time period. Please note that incurred payroll costs paid after that next payroll date after the applicable 8-week or 24-week period (such as commissions paid on a delayed schedule) should not be included. Consider accelerating the timing of your payment of commissions and bonuses so that they qualify for loan forgiveness.

Step 3: Check for and remove any exclusions, such as:

- Compensation for employees outside the United States

- Compensation for independent contractors (1099s)

- Employer portion of federal employment taxes, including FICA, Railroad Retirement Act taxes, and income taxes

- Any sick and family leave wages that are eligible for tax credits under the Families First Coronavirus Response Act (FFCRA)

Step 4: Apply the $100,000 cap per employee.

- Aggregate payroll cost per employee should be capped at $100,000 on an annualized basis.

Step 5: Add employer portion of state and local taxes as well as benefits.

- Include health insurance premiums and employer contributions to health FSAs and retirement funds.

- Include the employer portion of state and local taxes.

Step 6: Done -- this will be your Eligible Payroll Costs

If you’re a Rippling customer, we’ve created a report to automatically calculate your eligible payroll costs. Navigate to Reports on the left hand side panel, select the Built-in Reports tab, and select the Covid-19 Payroll PPP Forgiveness Report. Select your applicable dates and click Run Report. Please note that this report assumes that you are using a 24-week time period.For more details on this report, please check out our detailed methodology here.

If you’re not a Rippling customer or you would like to run your own calculations, we recommend the AICPA’s PPP loan forgiveness calculators.

Calculating Eligible Non-Payroll Costs

Step 1: Use the correct applicable time period.

- For the purposes of calculating eligible non-payroll expenses, you must use the 8 weeks or 24 weeks following your loan disbursement date.

Step 2: Calculate aggregate non-payroll costs.

- Include covered mortgage obligations, rent obligations, and utility payments provided that such obligations or services began before February 15, 2020. Essentially, you can’t claim non-payroll costs for brand new expenses.

Step 3: Calculate your cap for non-payroll costs.

- Non-payroll costs cannot be more than 40% of the total loan forgiveness amount. The easiest to calculate this cap is to multiply your “Eligible Payroll Costs” by 2/3.

- For example, if your Eligible Payroll Costs are $75,000, then your Non-Payroll Costs Cap will be $75,000 multiplied by 2/3, or $50,000.

Step 4: Compare Step 2 and Step 3, and take the smaller number.

- Using the example in Step 3, if your Aggregate Non-Payroll Costs are $100,000, but your Non-Payroll Costs Cap is $50,000, then you may only claim $50,000 in Eligible Non-Payroll Costs for the purposes of loan forgiveness.

Step 5: Done -- this will be your Eligible Non-Payroll Costs.

Please check out the AICPA PPP loan forgiveness calculators and worksheets if you require additional assistance in running these calculations.

Calculating your FTE Reduction Quotient (if applicable)

The PPP loan forgiveness rules state that you may only apply for 100% loan forgiveness if you have maintained the headcount of your employees. If you have reduced headcount, then the amount of loan forgiveness that you can apply for must be proportionally reduced. The PPP Loan Forgiveness Application calls this reduction ratio the “FTE Reduction Quotient.”

Step 1: Learn how to calculate your headcount (aka total full-time equivalent employees or “Total FTEs”) during an applicable time period.

- First, calculate the average full-time equivalency (“Average FTE”) of each employee paid wages during the applicable time period. By using a “full-time equivalent” calculation, your part-time employees will count as fractions of full-time employees. You may calculate Average FTE in two ways:

- Option 1 - Detailed Version: Calculate the average number of weekly hours worked during that time period, divide by 40 hours, round to the nearest tenth, and cap at 1.0.

- Option 2 - Simplified Version: Assign an Average FTE of 1.0 for each employee who worked 40 hours or more per week and assign an Average FTE of 0.5 for each employee who worked less than 40 hours per week. In the simplified version, all employees essentially count either as full employees or half employees.

- Second, add up the Average FTEs to arrive at your Total FTEs.

Step 2: Check to see whether one of the “FTE Reduction Safe Harbors” applies.

- Did you decrease your average Total FTEs between February 15, 2020 and April 26, 2020, but restore your average Total FTE levels by December 31, 2020?

- Did your average Total FTEs remain the same or increase between January 1, 2020 and the last day of your applicable 8-week or 24-week payroll period?

- If you answered “yes” to either question, then you will not need to reduce your PPP loan forgiveness amount and your FTE Reduction Quotient will be “1.” You can skip Steps 3 to 5 below.

Step 3: Calculate your headcount (Total FTEs) during the applicable 24-week time period used to calculate your Eligible Payroll Costs

- For the purposes of determining the Total FTE of this time period, you may count employees that you tried to rehire with a good faith, written offer, those employees who were fired for cause, voluntarily resigned, or voluntarily requested a reduction in hours, provided that these roles were not filled by new employees (aka “FTE Reduction Exceptions”).

Step 4: Calculate your headcount (Total FTEs) during your chosen reference period

- You may choose one of two reference periods:

- February 15, 2019 to June 30, 2019, or

- January 1, 2020 to February 29, 2020.

- Note that seasonal employers may also select a consecutive 24-week period between May 1, 2019 and September 15, 2019.

Step 5: Divide Step 3 by Step 4 and cap at 1.0.

Step 6: Done -- this will be your FTE Reduction Quotient

Calculating Your Wage Reductions (if applicable)

Wage reductions only apply if:

- You have employees who make less than $100,000 in annualized earnings;

- You reduced wages by more than 25% as compared to wages from January 1, 2020 to March 31, 2020; and,

- You do not restore wages by the last day of your 8-week or 24-week time period or December 31, 2020.

If all of the conditions above apply to your business, then you will need to subtract those wage reductions from your loan forgiveness totals. Please review the bottom of Page 7 of the PPP Loan Forgiveness Application for a worksheet on how to calculate the “Salary/Hourly Wage Reduction.”

How to collect supporting documentation

What do I need to submit with the PPP Loan Forgiveness Application?

- PPP Loan Forgiveness Calculation Form

- PPP Schedule A

- Payroll documents, including:

- (a) bank accountment statements or third-party payroll service reports,

- (b) tax forms or equivalent third-party payroll service reports,

- (c) documents showing employer contributions to employee health insurance and retirement plans

- FTE documents

- Non-payroll documents

Note: PPP Schedule A and FTE documents will not be required if using the EZ application.

What documents do I need to keep and for how long?

You will need to maintain records of your applications and documents supporting the representations made in those applications for six years. We suggest that you get a head start on gathering these documents, digitizing them, and storing them in a safe place. Maintaining good record keeping practices will be important should the SBA challenge your loan eligibility or loan forgiveness application, or request additional information from you.

Specifically, you will need to maintain records of:

- All documents submitted with or supporting your PPP Loan Application, including:

- PPP Loan Application

- Documents submitted with your PPP Loan Application

- Documents supporting borrower’s certifications as to necessity and eligibility

- Documents showing compliance with PPP requirements

- All documents submitted with or supporting your PPP Loan Forgiveness Application, including:

- PPP Loan Forgiveness Application

- Documents submitted with your PPP Loan Forgiveness Application

- (If applicable) Schedule A Worksheet or equivalents

- (If applicable) Documents supporting the listing of each individual employee in PPP Schedule A Worksheet Table 1 and Table 2

- (If applicable) Documents supporting the PPP Schedule A Worksheet “FTE Reduction Safe Harbor,” including documents regarding any full-time employee job offers and refusals, firings for cause, voluntary resignations, and written requests by any employee for reductions in work schedule.