When should you convert a contractor to an employee?

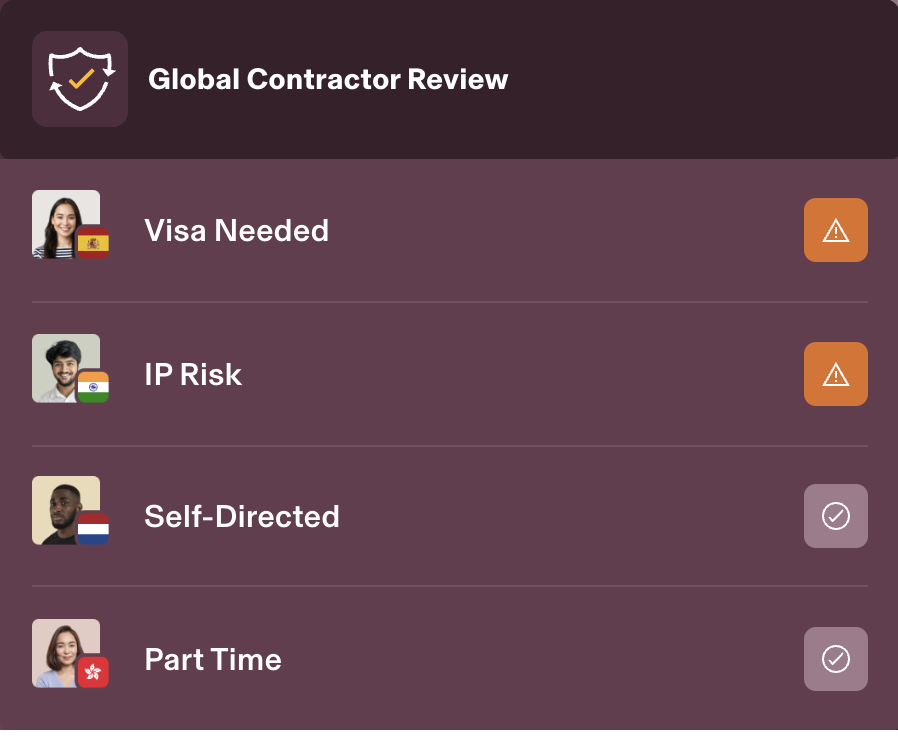

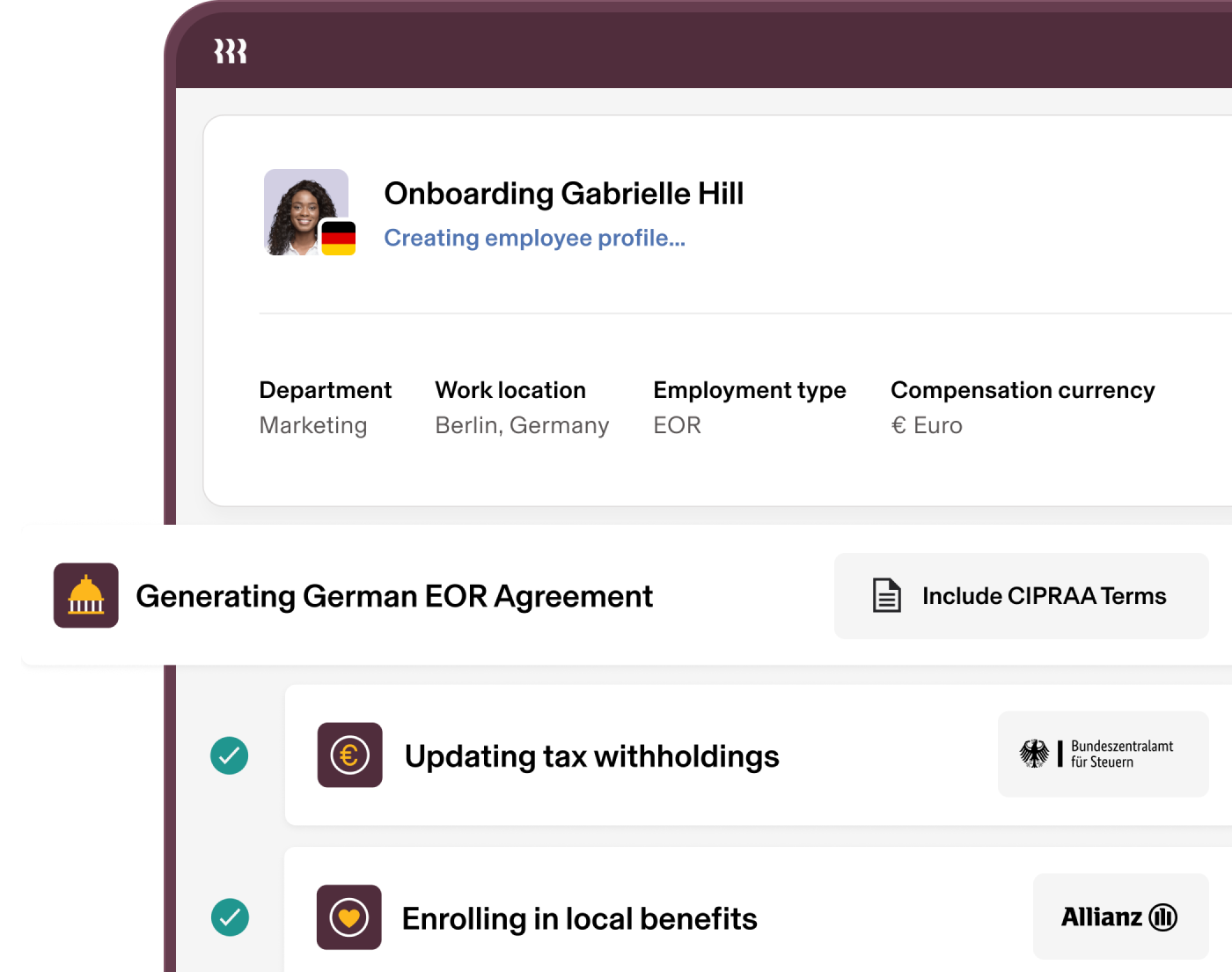

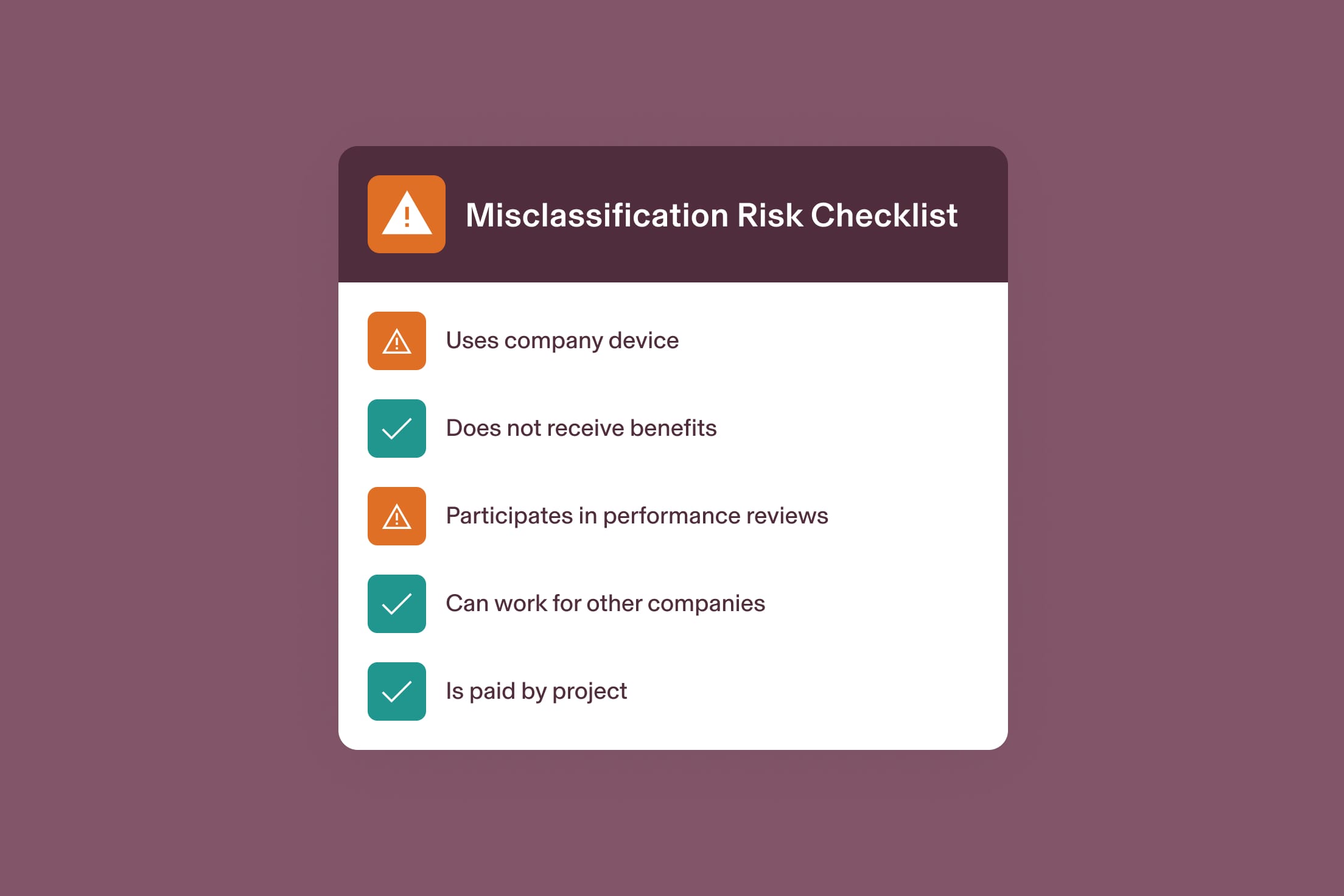

You should regularly assess whether to convert individuals classified as contractors to employees in order to mitigate costly risks that can hinder your organisation’s next stage of growth.

71% of HR professionals believe that VCs are less likely to invest in a startup that has faced compliance issues. You’ll need to constantly reassess your compliance practices to be ready for your next round or M&A.

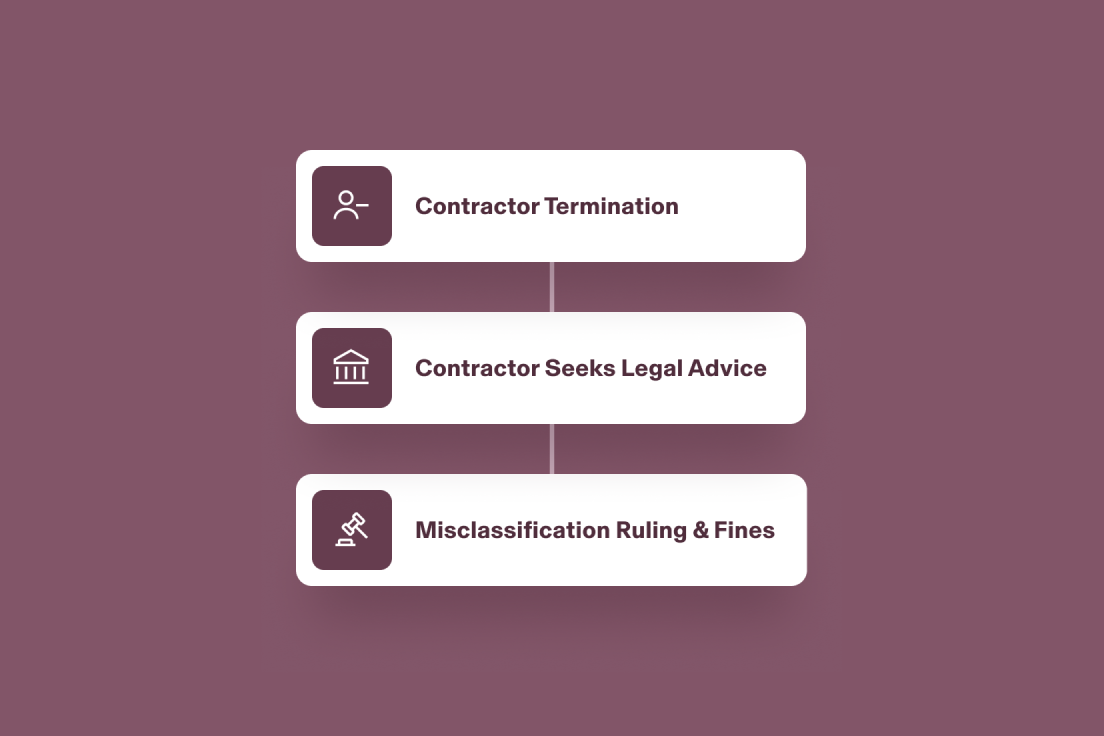

If you’re not careful, a terminated worker – even if they chose to be a contractor – may pursue legal action on the grounds of misclassification. Being proactive about risk protects you in the event of a future dispute.