Rippling Spend

Spend management software to stop waste at the source

Rippling gives you complete visibility and automated policy controls across every type of spend—saving you time and money in a spend management platform.

By clicking "See Rippling," you agree to the use of your data in accordance with Rippling's Privacy Notice, including for marketing purposes.

Category Leader: Spend Management on GetApp

Overall Leader: Expense Management on G2

4.9 stars 3k reviews on GetApp

Category Leader: Spend Management on GetApp

Smart tools make spend simple

Platform overview

Prevent spend from getting out of hand

Rippling brings all your spend tools under one roof, creating time-saving efficiencies and reducing software spending.

Centralize your spend

Manage and report on all types of spend across your org, all from one place—with built-in spend controls and real-time tracking.

Save time and money with custom policies

Leverage always-accurate employee data to create, automate, and enforce granular policies that optimize approval workflows and reduce overspending.

Slash software costs

Save on software spend and reduce manual admin with a single spend management tool.

Spend Management Software

Follow the money

Rippling spend management software helps you track expenses and conduct spend analyses down to the decimal—from employee spending and corporate cards, to travel and payroll—from a single location.

Expenses

Corporate Cards

Bill Pay

Payroll

Automations

Stay in policy automatically

Get spend right every time with dynamic policies and approval chains built on real-time transaction and employee data.

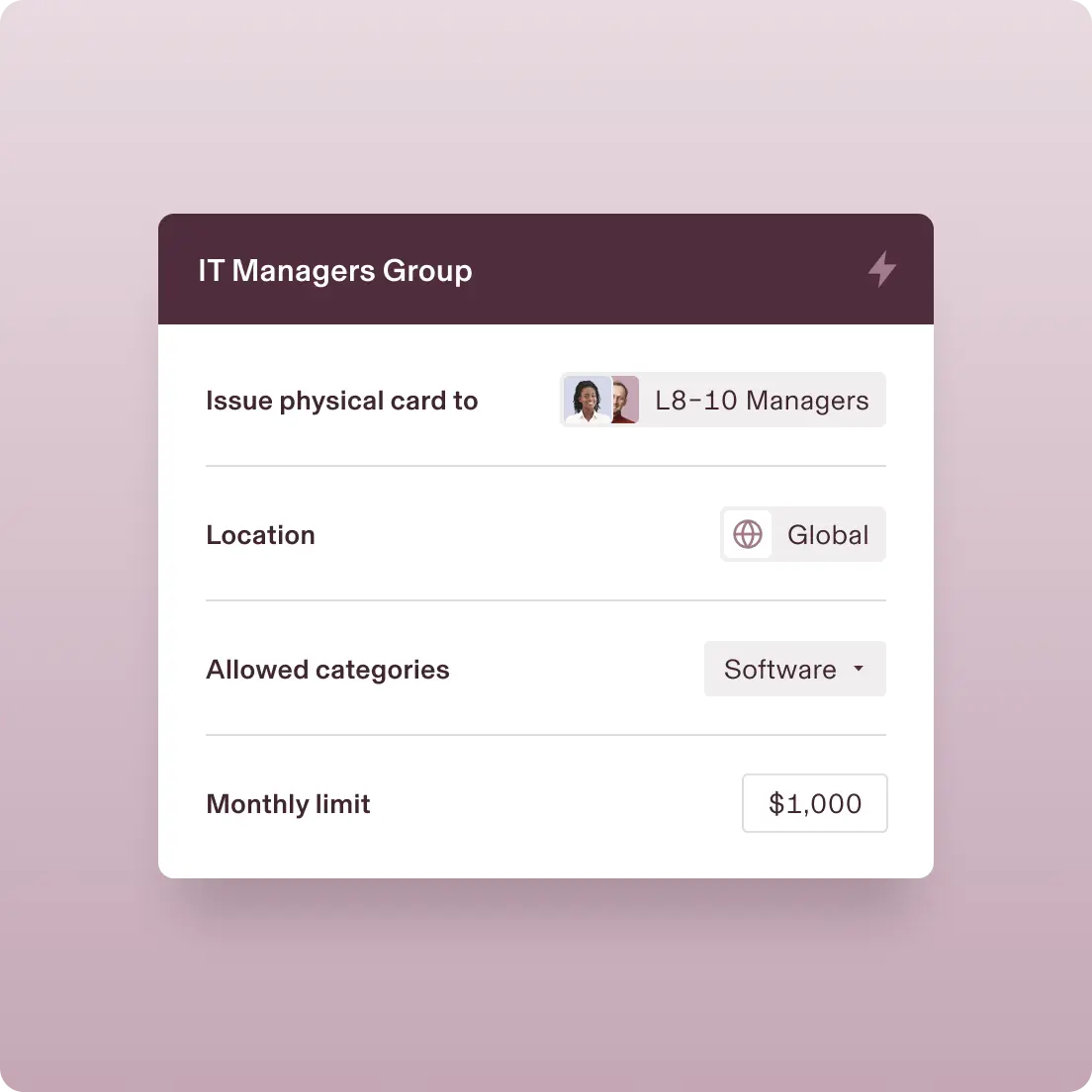

Card controls

Control spend before it happens with custom policies based on employee record, vendor, and transaction amount.

Expense approvals

Automatically route expense approvals to the right reviewers based on your custom policies and employee data.

Receipt requests

Auto-send SMS and email requests for required receipts any time a purchase is made on a corporate card.

VEndor consolidation

Spend less on your expense management

Swap out your disconnected point for a single, easy-to-use cloud-based system with powerful platform functionality, common UX patterns, and a lower overall cost.

Built different

Analyze, automate, and orchestrate anything

Most "all-in-one" software consists of acquired systems. These modules are disconnected, so your business data is, too. Rippling takes a platform approach, building products on a single source of truth for all the business data related to employees. This rich, flexible data source unlocks a powerful set of capabilities.

Permissions

Automatically govern what each person in your company can see, do, and access.

Policies

Build custom policies that enforce your business’s unique rules and procedures.

Workflows

Automate virtually anything with hyper-custom triggers and advanced workflow actions.

Analytics

Make better decisions faster with real-time, unified data in an easy-to-use report builder.

See Rippling Spend management software in action

FAQs

What is spend management software?

Spend management software gives companies complete control over their spending. It helps finance teams track, manage, and streamline all corporate spend—from employee expenses and virtual cards to vendor management—in one place. By automating approval workflows, enforcing custom policies, and having a single source of truth for spend data, spend management solutions can help reduce manual work, prevent overspending, and improve cash flow.

What are the key features of spend management software?

When choosing between business spend management system providers, you should look for key features like:

- Real-time spend visibility that gives you a complete view of corporate spending across teams, vendors, and categories

- Automated approval workflows that ensure every transaction follows the correct approval process with customizable rues

- Corporate cards and virtual cards that control employee spending with pre-set limits and automated notifications

- Quick bill payments that process invoices to vendors quickly with seamless integrations to accounting software like QuickBooks and NetSuite

- Spend controls and compliance to prevent overspending with built-in policy enforcement and automated flagging for policy violations

What is the difference between spend management and expense management?

While expense management focuses on tracking and reimbursing employee expenses, spend management takes a broader approach by overseeing all business spend.

- Expense management typically covers travel, meals, and other business expenses submitted by employees via expense reports.

- Spend management includes procurement, supplier management, bill payments, corporate card transactions, and strategic sourcing, providing a complete picture of company spend.

How do you run expense management?

Rippling makes expense management a breeze. We make it easy for admins—of all kinds of companies—from small businesses to enterprises—to create and customize policies to control spending. We make it even easier for employees to submit expenses, either through email, receipt upload, or manual entry. All expenses are automatically routed to the right approvers for fast processing, and expense details are made visible on employee profiles for total transparency.

What are corporate cards?

Corporate cards at Rippling are primarily used for paying travel & entertainment expenses, subscriptions & SaaS fees, payables, and other recurring monthly operational expenses. However, using corporate cards for inventory or capital asset purchases is discouraged due to higher default rates associated with such usage. These cards are owned by the employer, paid by the business, and the business holds liability for any delinquent payments or debts, with employers having full visibility into spend requests and the ability to set credit limits.

What is the best way to pay company bills?

To pay company bills with Rippling, follow these steps:

- Consolidate, Automate, Accelerate:

- Get a complete view of your company's spending and real-time bill payment reporting.

- Automatically route bill approvals to the right approvers based on employee data.

- Instantly create bills with GL coding and automatic syncs to accounting

integrations.

- Payment Options:

- Send payments via ACH, checks, or wire transfers to accommodate vendor preferences.

- Facilitate the transition for vendors who prefer traditional checks by using Rippling's Bill Pay email address.

- Key Features:

- Advanced Policy Engine: Ensures bills are routed correctly and paid on time.

- Instant Bill Creation: Automatically captures invoice details for quick processing.

- International Bill Payments: Pay bills in the vendor's local currency with currency exchange handled by Rippling.

- Vendor Portal: Allows vendors to update information, send invoices, and receive payments.

- Accounting Integrations: Syncs bills to preferred accounting systems for streamlined financial management.

Loans made or arranged pursuant to a California Financing Law License.

NMLS Company Identification 1931820.

Rippling Visa® Corporate Cards are powered by Stripe and issued by Celtic Bank.